Creating A New Loan Product or Type #

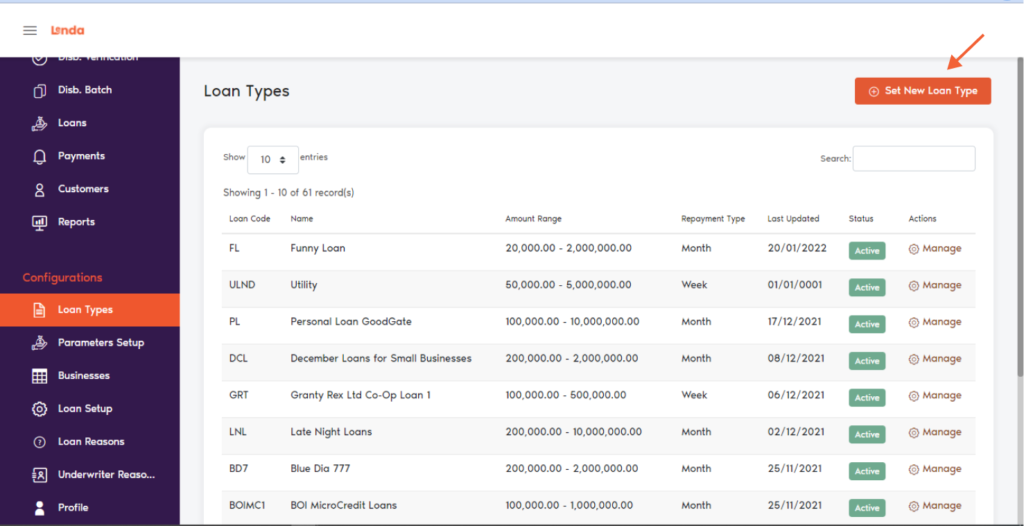

Users can create loan products with permission to Create Loan Types by going to the Loan Type option in the sidebar and using the Set New Loan Type button at the top right.

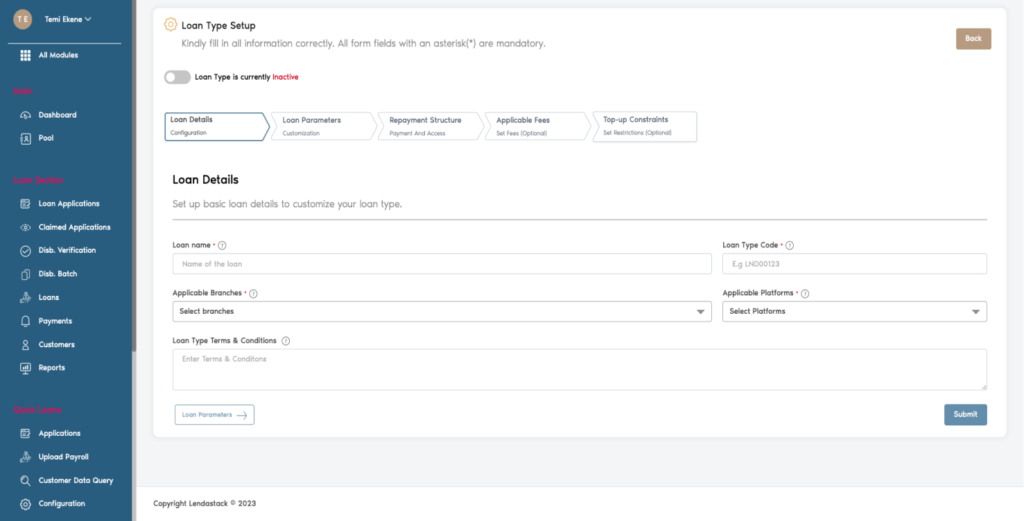

This should produce a form that contains the following sections:

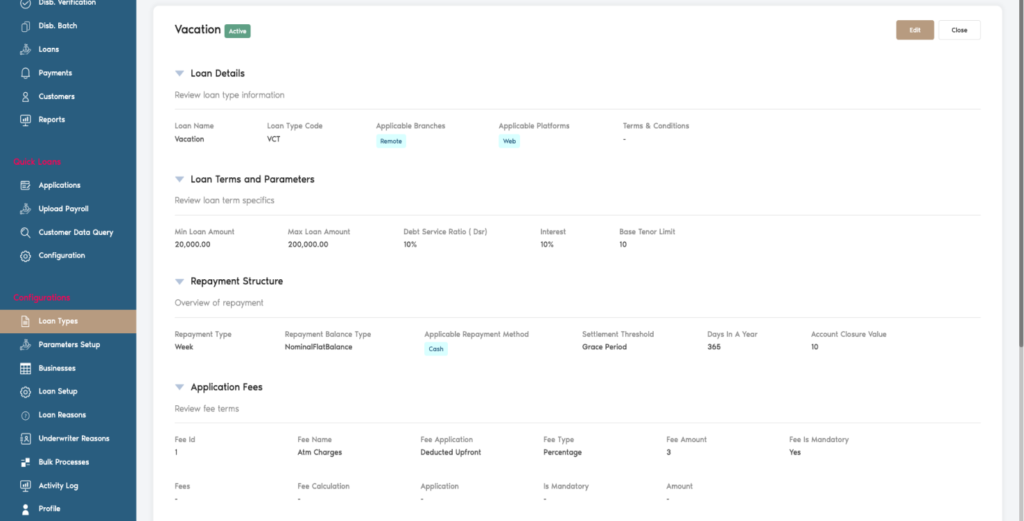

Loan Details: Set up basic loan details to customise your loan type.

Loan Name – Input a name. This will be used to identify the loan type.

Loan Type Code – Input a code to match your loan type. This will search for loans and segment them according to type.

Applicable Branches – Select locations through which the Borrower can make repayments.

Applicable Platforms – Select channels through which the Borrower can make repayments.

Status

Loan Type Terms & Conditions – Provide your users with the terms of service in detail.

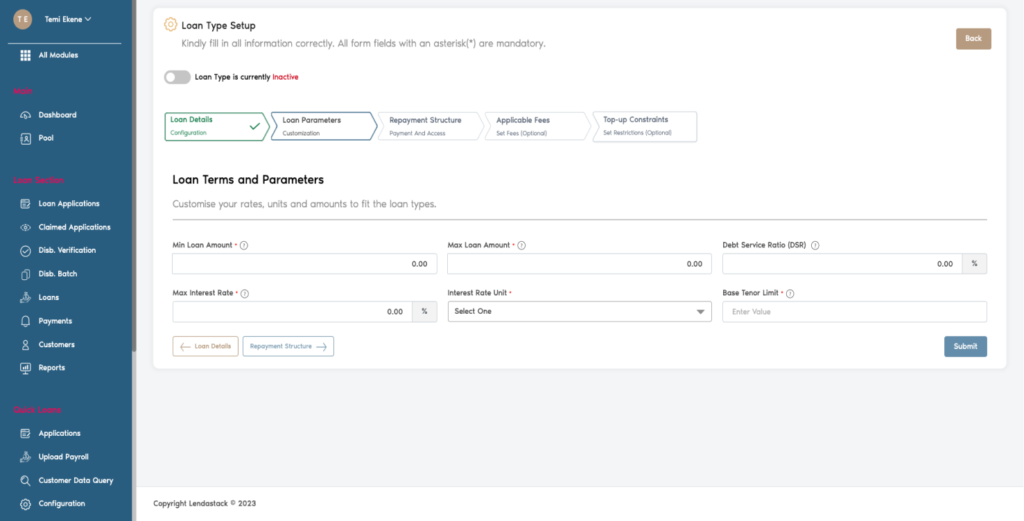

Loan Terms and Parameters: Customise your rates, units, and amounts to fit the loan type.

Min Interest Rate – Rate of interest that will result in the minimum interest amount. Borrowers cannot be charged lower than this rate.

Max Interest Rate – Rate of interest that will result in the maximum interest amount. Borrowers cannot be charged higher than this rate.

Debt Service Ratio (DSR) – Minimum ratio in which a loan can be approved for disbursement. Set this number by dividing Borrowers’ disposable income by debt.

Min Loan Amount – Minimum amount that can be disbursed in this loan type. Borrowers cannot select an amount less than this.

Max Loan Amount – Maximum amount that can be disbursed in this loan type. Borrowers cannot select an amount greater than this.

Base Tenor Limit – Maximum length of time the loan must be fully repaid. Input a period in months when the borrower must fully repay the loan.

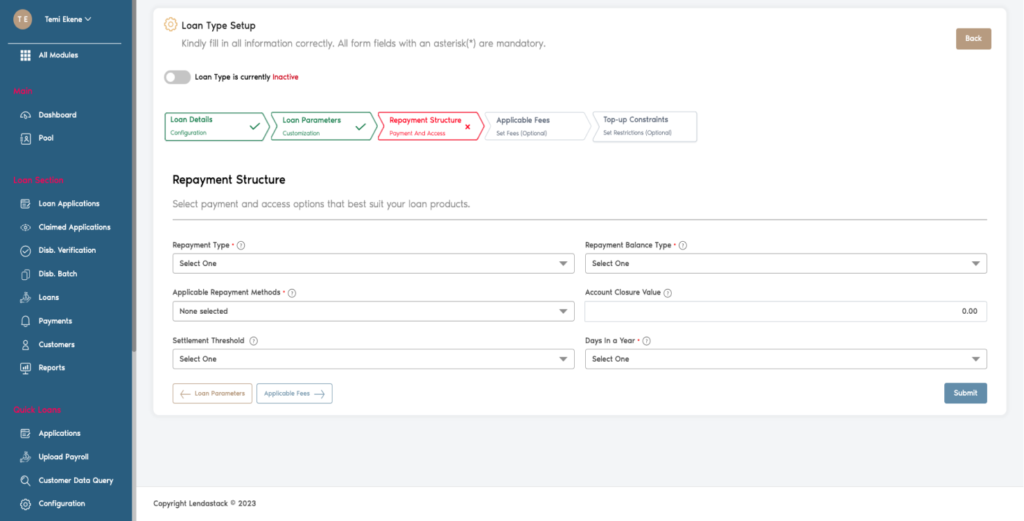

Loan Repayment Structure: Select payment options for borrowers that best suit your loan product.

Repayment Type – Select a schedule for the borrower as a guide to paying back the loan

Applicable Repayment Methods – Select repayment options from the drop-down menu.

Days in a year – Customise the number of days preferred in a Fiscal calendar year.

Settlement Threshold – Select a threshold for loan repayment

Account Closure Value – Minimum amount

Repayment Balance Type – Select a repayment balance type from the dropdown

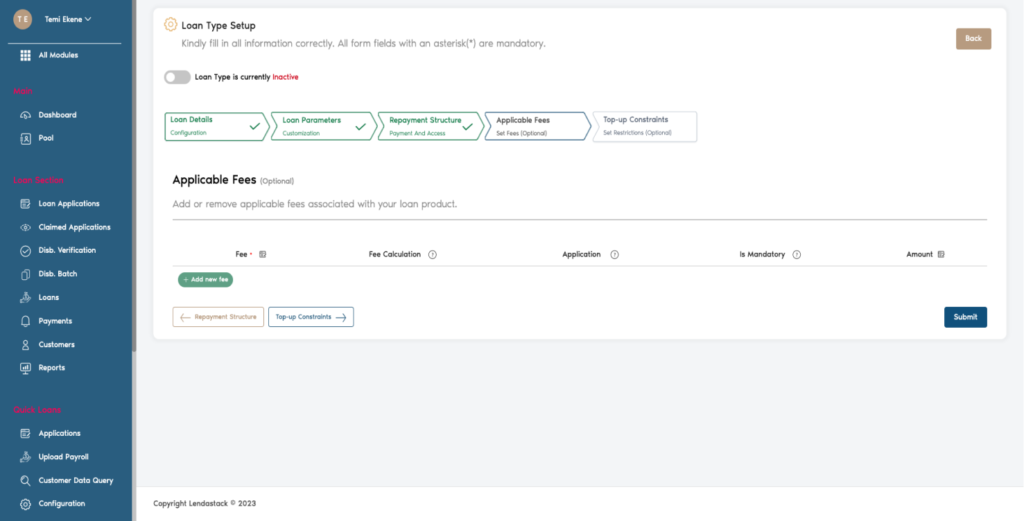

Application Fees: Add or remove application fees associated with your loan product.

Fees: Select the fee name from the dropdown

Fee calculation: Select if the fee is Deducted upfront or Capitalized

Applications: Select from the dropdown the Percentage % of the Loan amount.

Is Mandatory: Select if the fee is mandatory or not

Amount: Amount of the fee

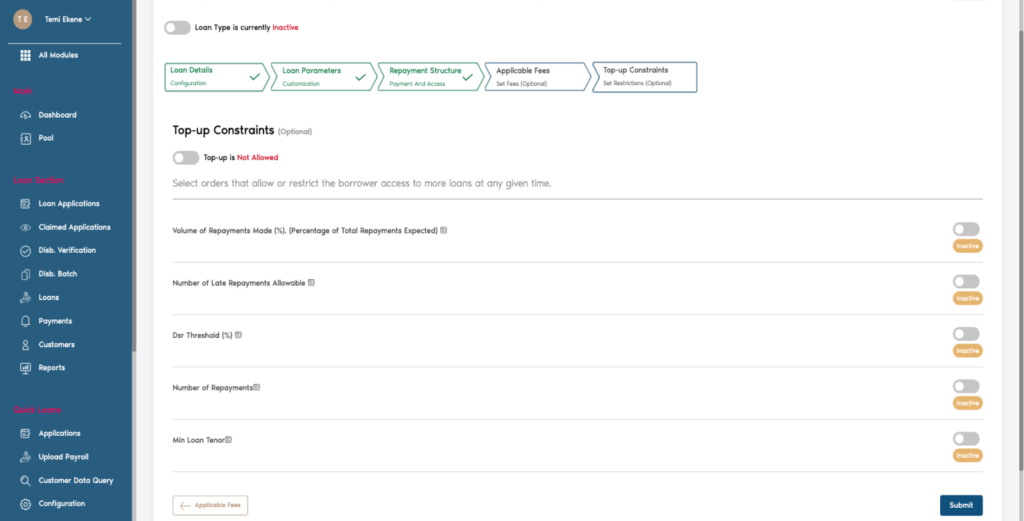

Top-up Constraints: Select orders that allow or restrict the borrower access to more loans at any time.

Volume of Repayments Made (%). The borrower must have repaid this percentage of the debt before having access to more loans.

DSR Threshold (%) – Borrower must have this debt service ratio before having access to more loans.

Number of Repayments – Borrower must have made this number of repayments on debt before having access to more loans.

Min Loan Tenor – The Borrower must have paid back the loan in the minimum amount of time required to access more loans.

Number of Late Repayments Allowable – Borrower must have had less than the allowed number of late repayments before having access to more loans.

Once all compulsory form fields and sections have been filled, click on the submit to save the loan type.

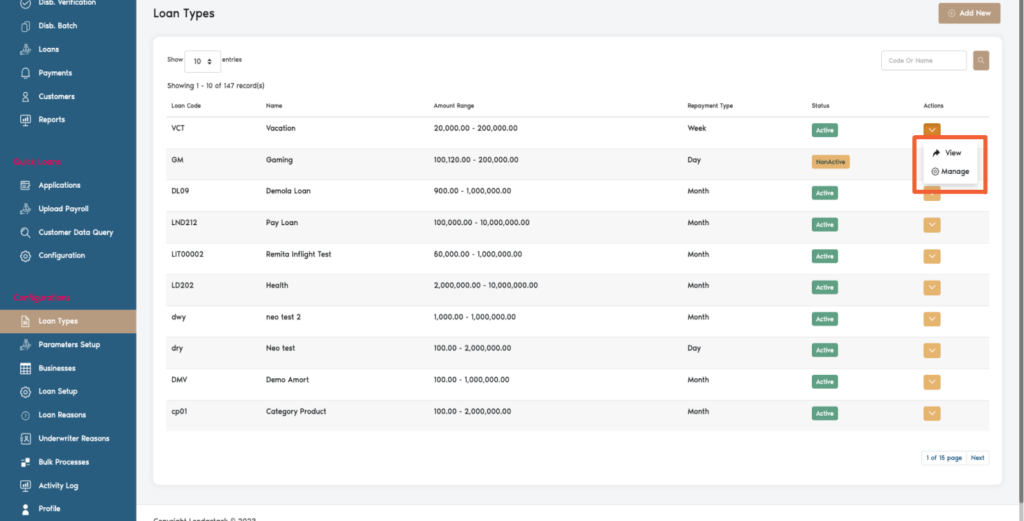

After submitting, the loan type appears in the table below and can be viewed or edited.

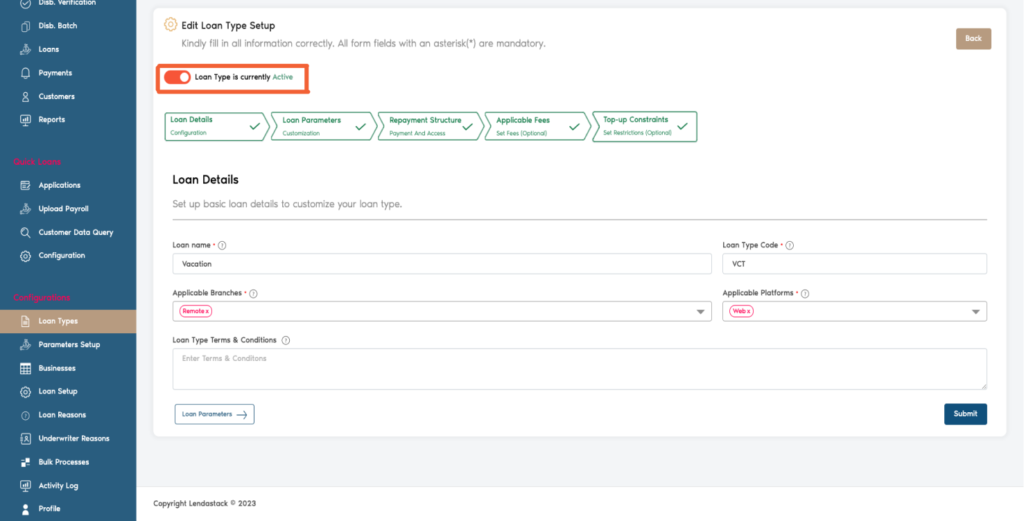

To view, click on the “Action” button dropdown as seen above. The two options there are “View” which is to see the loan type details & “Manage” which is to edit the form if necessary. See the images below.

After editing form details where necessary, click on the submit to save changes. Users can also Activate or deactivate loan type by turning the toggle highlighted below on or off.